41 central bank digital currency

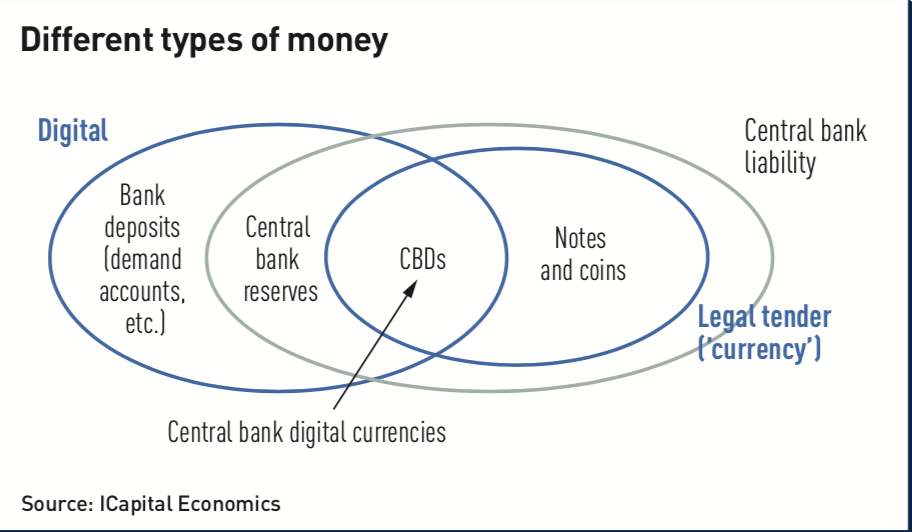

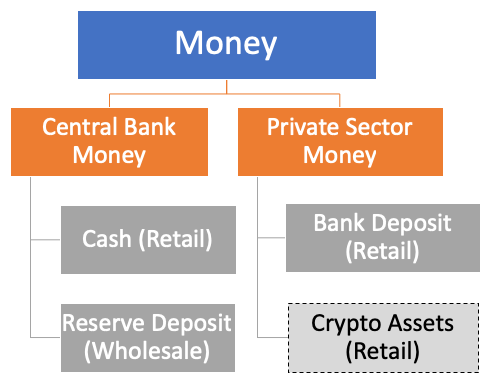

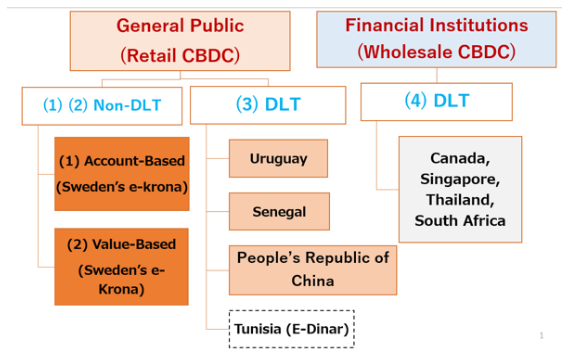

What Is Central Bank Digital Currency (CBDC)? | The Motley Fool Wholesale central bank digital currencies. Wholesale CBDCs would be used by financial institutions. Banks and other financial institutions could use a central bank's CBDC to transfer funds and settle transactions more quickly. While this type of CBDC would improve efficiency for domestic payments... Central Bank Digital Currency (CBDC): In-Depth Guide in 2022 Central bank digital currencies (CBDCs) are a digital form of the currency issued by a central bank. They are regulated by a country's monetary authority, and are implemented using a database which is controlled by the central bank, government, or authorized private-sector entities.

CBDC | Central Bank Digital Currency — MIT Digital Currency... -Stablecoins. -Central bank digital currencies. What is the future of money? Neha Narula, Director of Digital Currency Initiative MIT Media Lab, talks to Ira The rapid rise of digital dollar stablecoins has been paralleled by accelerating interest from central bankers on the role and possibilities of Central...

Central bank digital currency

Federal Reserve Board - Central Bank Digital Currency (CBDC) Jan 20, 2022 · Central Bank Digital Currency (CBDC) While the Federal Reserve had made no decisions on whether to pursue or implement a central bank digital currency, or CBDC, we have been exploring the potential benefits and risks of CBDCs from a variety of angles, including through technological research and experimentation. Digital Currency: Central Banks Get Started with Digital Money These Central Bank Digital Currencies (CBDCs) , issued by government-mandated financial institutions, hold equal legal status as their fiat currency counterparts. For example, DCash is the CBDC issued by the Eastern Caribbean Central Bank for seven countries. CBDC tracker Central Bank Digital Currencies are a new form of electronic money that, unlike well-known cryptocurrencies, are issued by central banks of certain countries. CBDC Tracker is an information resource for CBDC with news, updates and technology information.

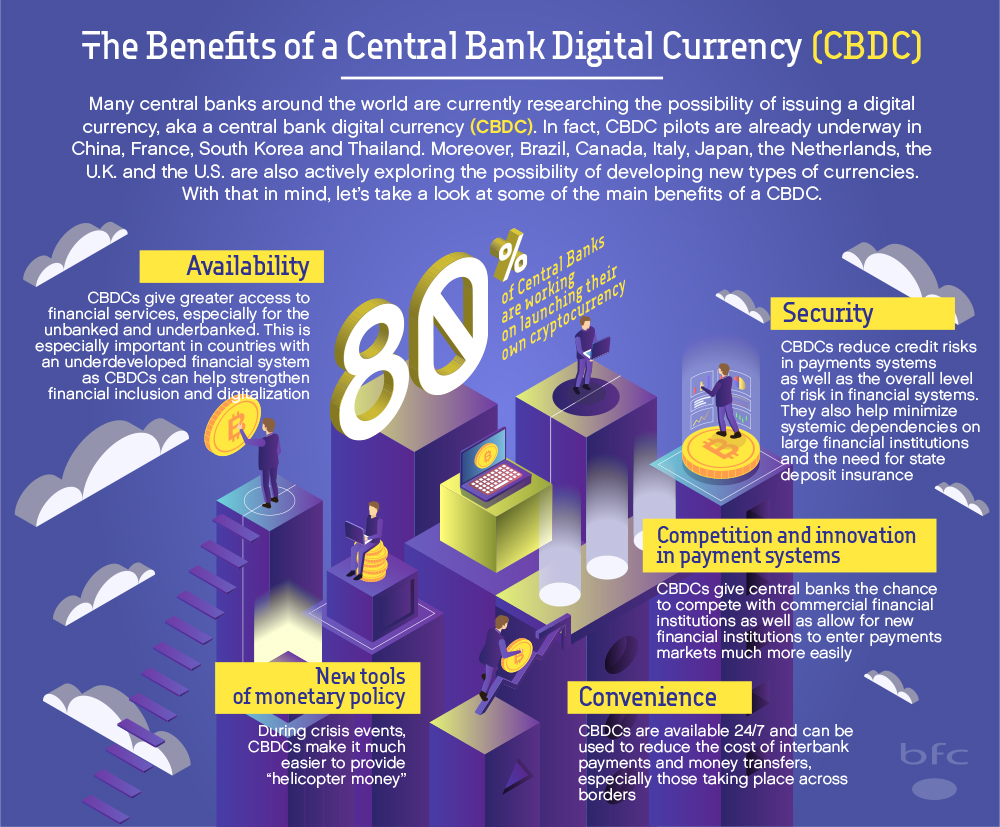

Central bank digital currency. Opinion: Central bank digital currencies are coming. The US ... Aug 13, 2021 · Unlike bitcoin, CBDCs are issued by governments and are basically digital versions of an existing national currency. But instead of holding it in your wallet, you store it on your phone. Central Bank Digital Currency Tracker - Atlantic Council What exactly is a Central Bank Digital Currency (CBDC)? A CBDC is virtual money backed and issued by a central bank. As cryptocurrencies and stablecoins have become more popular, the world's central banks have realized that they need to provide an alternative—or let the future of money pass... PDF Central Bank Digital Central Bank Digital Currency. Benefits and drawbacks. Prompted by technological advances and a decline in cash usage, many Central Banks are investigating whether it would be possible to issue a digital complement to cash, a so-called Central Bank Digital Currency (CBDC). Why central banks want to launch digital currencies The People's Bank of China has been developing the digital yuan, a so-called central bank digital currency that aims to replace some of the It's effectively a way for the central bank to digitalize bank notes and coins in circulation. The Chinese market is already very advanced in cashless...

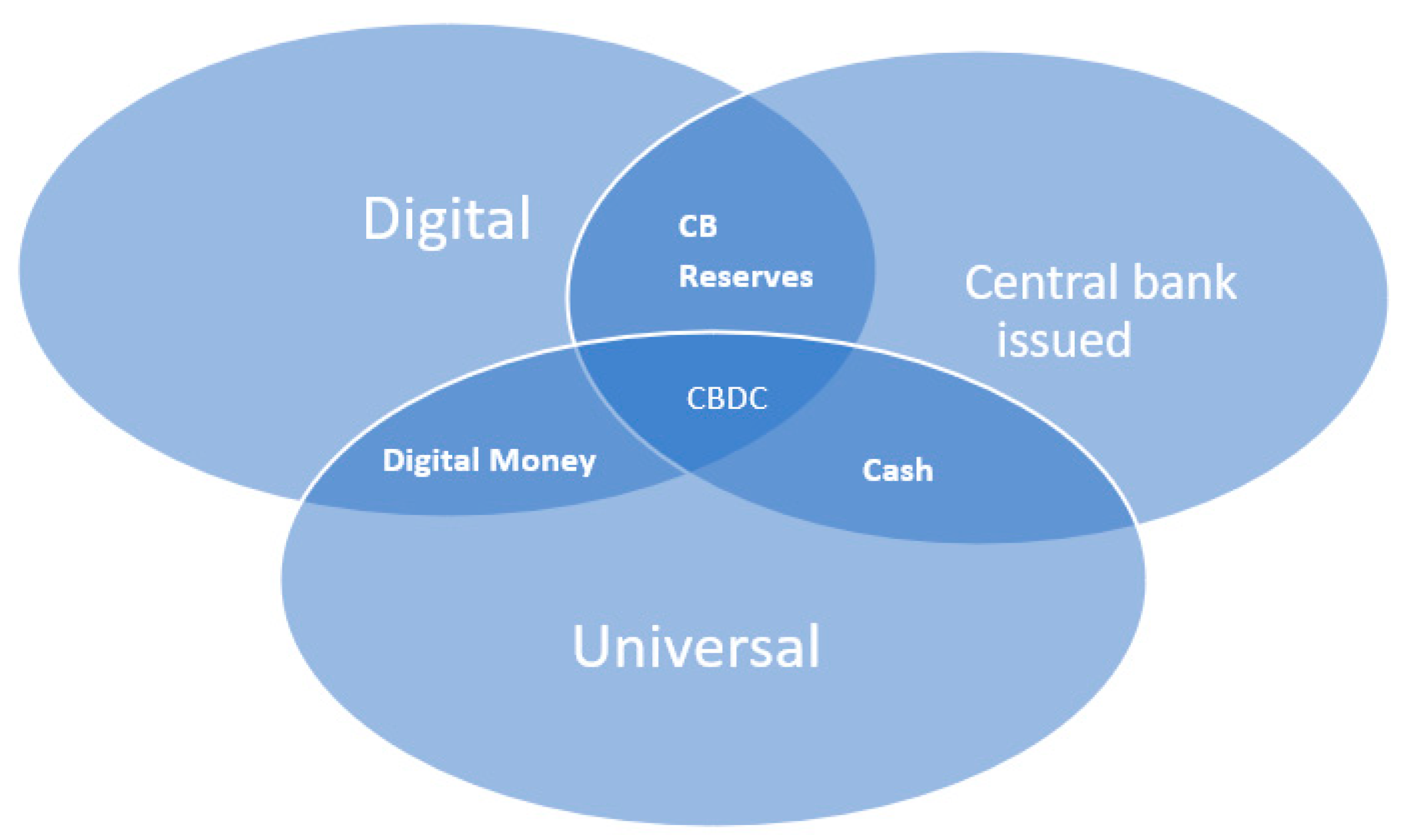

What is a central bank digital currency (CBDC)? | Hedera CBDC is short for Central Bank Digital Currency — it's an electronic form of central bank money that citizens can use to make digital payments and store value. A CBDC is a digital currency, it's issued by a central bank, and is universally accessible. Pros and Cons of Central Bank Digital Currency - 101 Blockchains However, the central bank digital currency cons present implications towards instability in monetary policy and the financial services industry in general. The following discussion outlines the background of CBDCs and the essential assumptions before diving into their advantages and setbacks. PDF Central bank digital currency in an open economy Keywords: Central bank digital currency, DSGE model, open-economy, optimal monetary policy, international monetary system. Spurred by competition from innovative payment solutions developed by the private sec-tor, central bank digital currency (CBDC) has received signicant attention in both... CENTRAL BANK DIGITAL CURRENCY Recently, the issuance of central bank digital currency (CBDC) has become a highly debated financial-sector topic world-wide. Rapidly evolving technology and its application to practically all areas of finance—but especially in the issuance of value in electronic forms—has made it possible for central

The Future of Money: Gearing up for Central Bank Digital Currency Central banks are rolling up their sleeves and familiarizing themselves with the bits and bytes of digital money. These are still early days for CBDCs and We also saw in all three active CBDC projects—in the Bahamas, China, and the Eastern Caribbean Currency Union—that they placed limits on holdings... Fed Paper on US Central Bank Digital Currency (CBDC) Jan 21, 2022 · Central Bank Digital Currency (CBDC) is the digital form of a country's fiat currency, which is regulated by its central bank. more Federal Reserve System (FRS) Definition Central bank digital currencies - Bank for International ... bank digital currency (CBDC). This consolidated report is an early contribution to this topic, providing a conceptual analysis of the potential effect of CBDC in three core central banking areas: payments, monetary policy implementation The benefits of central bank digital currency | VOX, CEPR Policy... Central banks across the world are considering sovereign digital currencies. This column argues that these currencies could transform all aspects of the monetary system and facilitate the systematic and transparent conduct of monetary Central bank digital currency and the future of monetary policy.

Design choices for central bank digital currency Central bank digital currency (CBDC)—fiat currency issued by central banks in digital form—has progressed in the past few years from a bold speculative concept to a seeming inevitability. Sarah Allen. Community Manager - Initiative for Cryptocurrencies and Contracts. James Grimmelmann.

How Central Banks Think About Digital Currency Central bank digital currencies are on the horizon. A CBDC adopts certain characteristics of everyday paper or coin currencies and cryptocurrency. It is expected to provide central banks and the monetary systems they govern a step towards modernizing.

PDF 2. Central Bank Digital Currency The Central Bank Digital Currency is relatively a new concept, but the exploratory and experimental phase has already been forwarded, as well as Figure 1: The path to Central Bank Digital Currency. From Crypto-assets… First Digital Assets based on Blockchain technology with their own monetary...

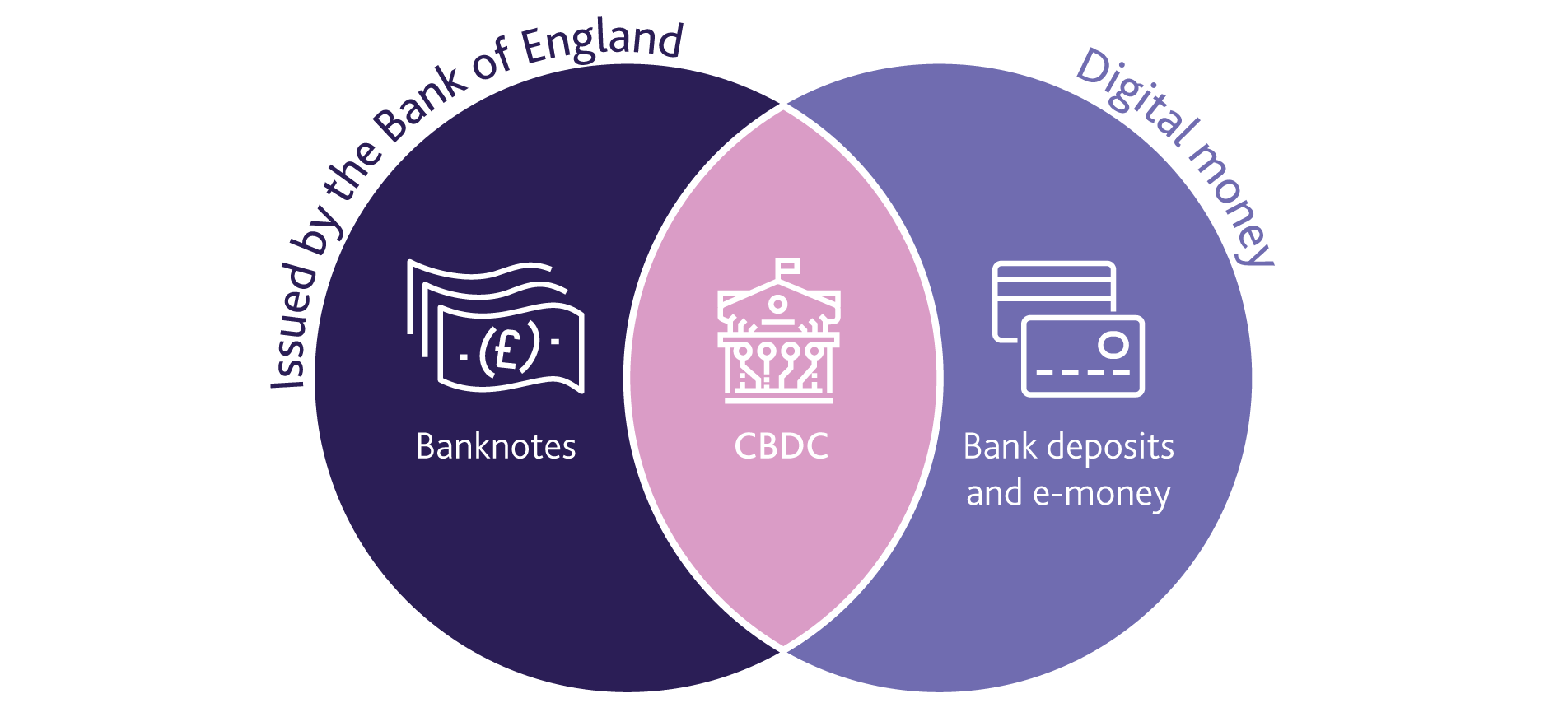

Central bank digital currency (CBDC): a digital payment instrument... Central bank digital currencies should be viewed in the context of these functions of the central bank in the monetary system. Wholesale CBDCs are for use by regulated financial institutions. They build on the current two-tier structure, which places the central bank at the foundation of the payment system...

What are "Central Bank Digital Currencies" (CBDCs)? - Securities.io Central Bank Digital Currencies share some important aspects with traditional cryptocurrencies such as Bitcoin and Ethereum. For one, they utilize blockchain technology to facilitate speedy transactions and monitor market activity. Consequently, CBDCs function very similar to your normal...

Central bank digital currencies | Bank of England A Central Bank Digital Currency (CBDC) would allow households and businesses to directly make electronic payments using money issued by the Bank of England. We have not yet made a decision on whether to introduce CBDC.

The Fed - Central Bank Digital Currency: A Literature Review The first strand of the literature asks how CBDC will affect commercial banks. Fundamentally, CBDC can serve as an interest-bearing substitute to commercial bank deposits. Faced with such a substitute, commercial banks may respond by changing the deposit rates they offer to savers and, because of the resulting impact on banks' funding cost, the terms of the loans they offer to borrowers. As a result, both the quantity of bank deposits and the volume of bank-intermediated lending may change with the introduction of a CBDC. In this respect, this strand of the literature can speak to the concern of some policymakers that the introduction of CBDC may replace banks' main source of funding and cause disintermediation of commercial banks, which in turn may lead to a decrease in their lending. Andolfatto (2018) studies these effects on a monopoly bank. In his paper, when the CBDC is interest-bearing, the bank, which makes positive profits in equilibrium, raises the equilibrium deposit rate...

Central Bank Digital Currency What is Central Bank Digital Currency? COVID-19 has raised concerns about the hygiene of paper money. CBDC, in simplest terms, is the digital form of fiat currency established by the government / central bank. The Bank of England has called it a "digital banknote" as opposed to a physical...

Central bank digital currency - Wikipedia The phrase "central bank digital currency" (CBDC) has been used to refer to various proposals involving digital currency issued by a central bank.

Central Bank Digital Currency — CBDC | by paradigm shift | Medium Central Bank Digital Currency is not Cryptocurrency. „This section gauges whether central banks could benefit from CBDC to more fully achieve public policy goals. These include satisfying the social dimensions of money's three functions, as well as financial integrity, financial stability...

Central Bank Digital Currency (CBDC) Definition Central bank digital currencies are digital tokens, similar to cryptocurrency, issued by a central bank. They are pegged to the value of that country's fiat currency. Many countries are developing CBDCs, and some have even implemented them into their financial systems.

Central bank digital currency and stablecoin: Early... | McKinsey The European Central Bank announced recently it was progressing its 'digital euro' project into a more detailed investigation phase. The basic notion of a digital currency (replacing the need for paper notes and coins as a means of exchange with computer-based money-like assets) dates back more...

The Fed - What is a Central Bank Digital Currency? May 20, 2021 · Central bank digital currency (CBDC) is a generic term for a third version of currency that could use an electronic record or digital token to represent the digital form of a nation's currency. CBDC is issued and managed directly by the central bank and could be used for a variety of purposes by individuals, businesses, and financial institutions.

CBDC tracker Central Bank Digital Currencies are a new form of electronic money that, unlike well-known cryptocurrencies, are issued by central banks of certain countries. CBDC Tracker is an information resource for CBDC with news, updates and technology information.

Digital Currency: Central Banks Get Started with Digital Money These Central Bank Digital Currencies (CBDCs) , issued by government-mandated financial institutions, hold equal legal status as their fiat currency counterparts. For example, DCash is the CBDC issued by the Eastern Caribbean Central Bank for seven countries.

Federal Reserve Board - Central Bank Digital Currency (CBDC) Jan 20, 2022 · Central Bank Digital Currency (CBDC) While the Federal Reserve had made no decisions on whether to pursue or implement a central bank digital currency, or CBDC, we have been exploring the potential benefits and risks of CBDCs from a variety of angles, including through technological research and experimentation.

0 Response to "41 central bank digital currency"

Post a Comment