42 share buyback meaning

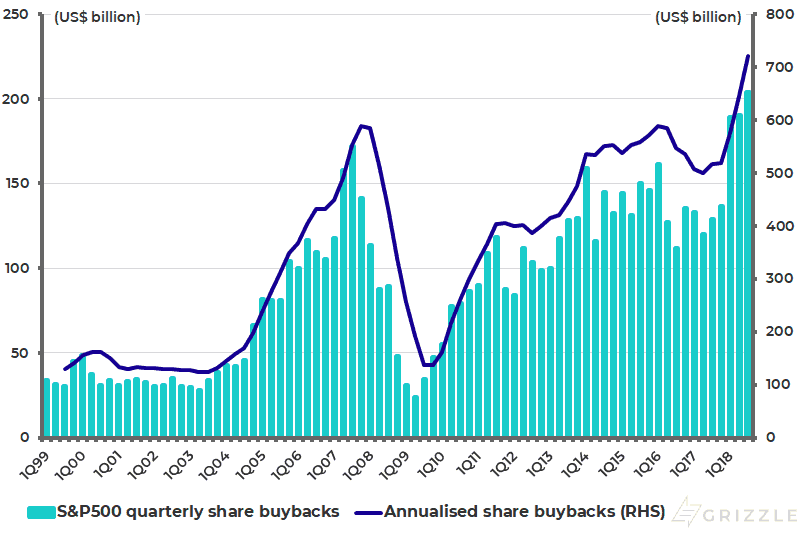

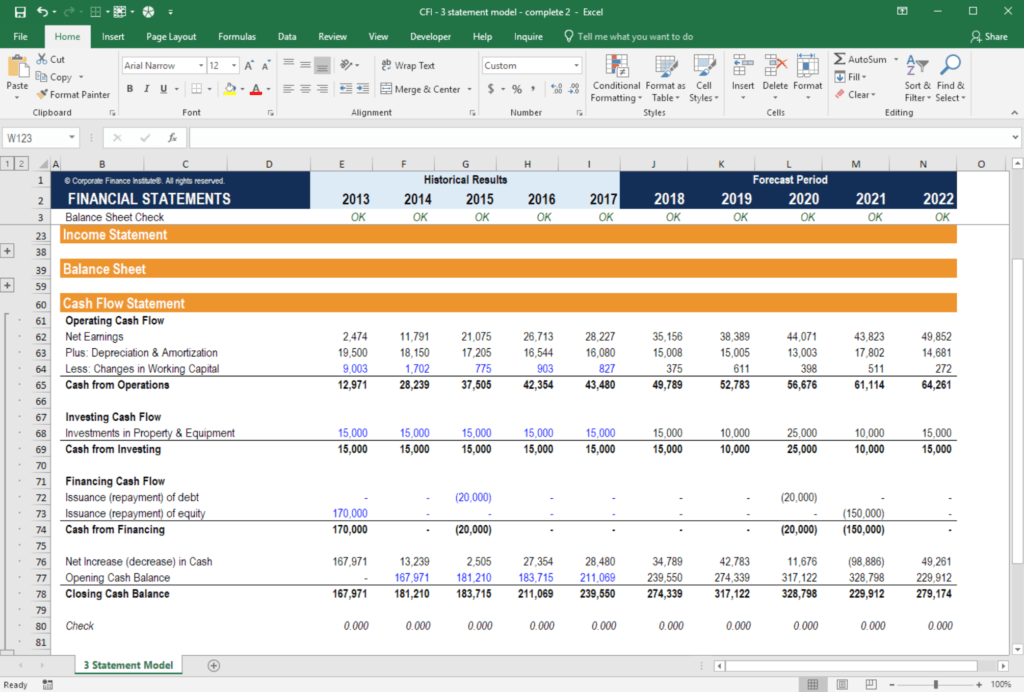

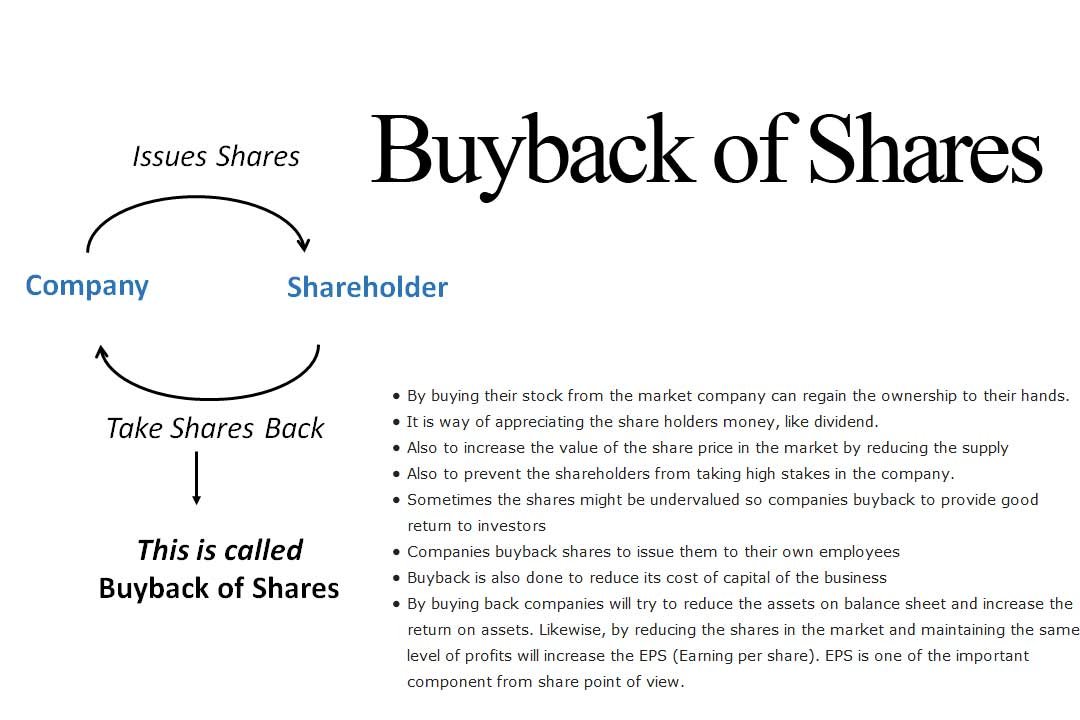

What Is a Buyback? - The Balance A stock buyback occurs when a company buys outstanding shares of its own stock with excess cash or borrowed funds. A buyback increases the value of outstanding shares. It reduces the number of total shares on the market, which increases the earnings per share (EPS). One alternative is to pay dividends to investors. Stock Buybacks: Examples, Definition & Benefits A definition of stock buybacks is below: Stock buybacks (also called share repurchases or stock repurchases) are when a publicly traded business uses cash to buy back some of its outstanding shares. Stock buybacks reduce the amount of shares outstanding. This is good for the remaining shareholders. An example is below.

Amazon announces 20-for-1 stock split, $10 billion buyback The company also said its board has authorized Amazon to buy back up to $10 billion worth of shares. Andy Jassy, chief executive officer of Amazon.Com Inc., during the GeekWire Summit in Seattle ...

Share buyback meaning

Share Repurchase Definition - investopedia.com A share repurchase, or buyback, is a decision by a company to buy back its own shares from the marketplace. A company might buy back its shares to boost the value of the stock and to improve the ... Buyback Definition A buyback is when a corporation purchases its own shares in the stock market. A repurchase reduces the number of shares outstanding, thereby inflating (positive) earnings per share and, often, the ... What Does AMD's Buyback Mean for Its Stock Investors love a bit of share buyback action, and Advanced Micro Devices (AMD) has been partaking in plenty of it recently. Last week, the chip giant disclosed it had authorized a new $8 billion ...

Share buyback meaning. › blog › types-of-shareholdersTypes of Shareholders - Meaning & Example of Shareholders Sep 08, 2020 · Equity shareholders are entitled to Bonuses and Rights and can also participate in Buyback. Further, equity shareholders can also be categorized as per their shareholding pattern into promoters, Institutional investors (foreign and domestic), and the public. 2. Preference Shareholder: › article › m-g-to-launch-500mM&G to launch £500m share buyback after meeting demerger ... Mar 09, 2022 · A £500 million share buyback is to be launched by M&G after the investment group hit several targets set as part of its separation from Prudential in 2019. John Foley, chief executive, said it ... Buyback of Shares Meaning, Procedure and Taxation Explained Buyback of shares meaning A buyback of shares is buying back of own shares by a company that was issued earlier. It is a corporate action event wherein a company makes a public announcement for the buyback offer to acquire the shares from existing shareholders within a given timeframe. Share buyback: DECODED! Meaning, process, benefits, risks ... Share buyback: DECODED! Meaning, process, benefits, risks, price calculation, procedure and should you participate in it or not - Get all answers here. Here is the explanation of share buyback and what you as an investor should do. All questions related to share buyback answered here:- View in App

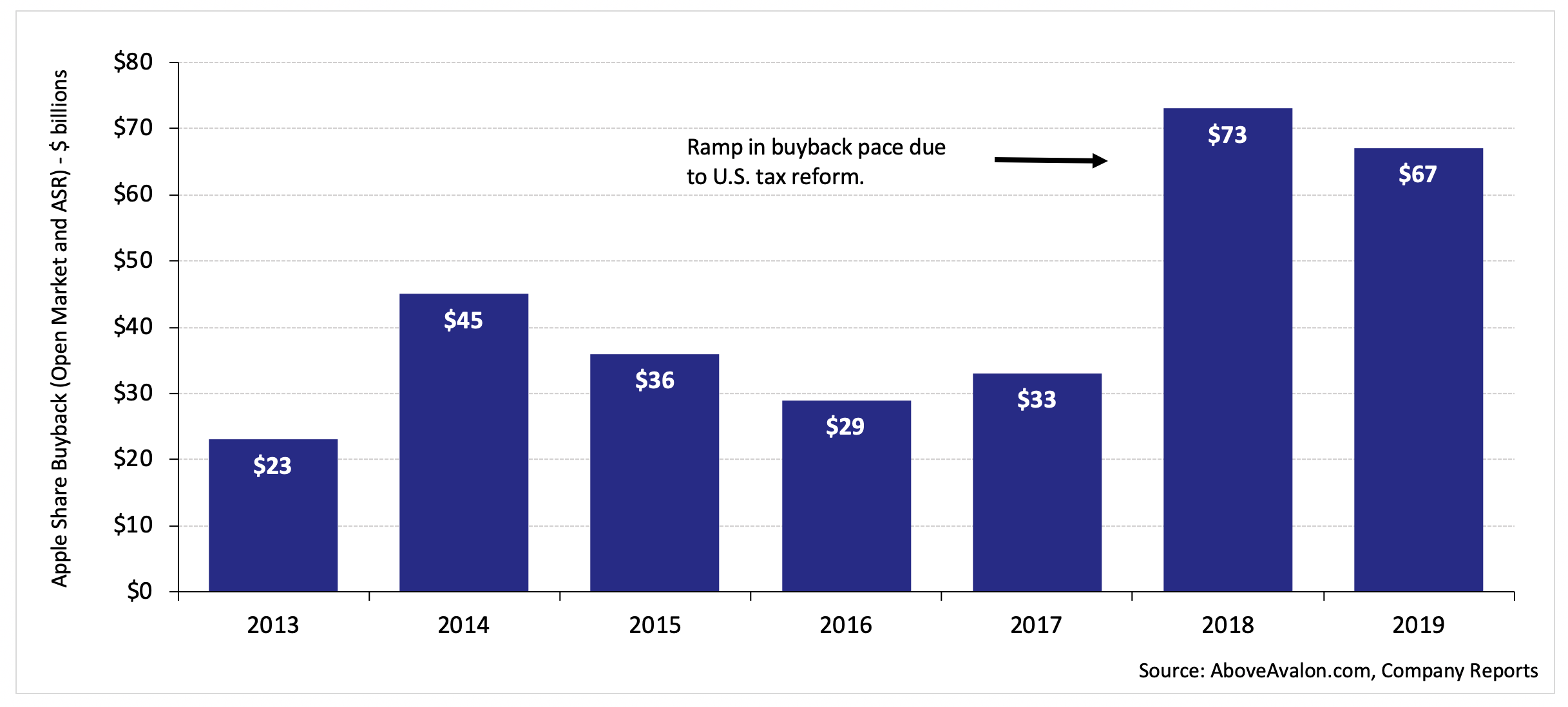

Stock Buybacks - What It Means When a Company Repurchases ... Stock buybacks, often referred to as share buybacks or share repurchases, are repurchases of stock in the open market by the issuing company. That's right, if Apple announces a share buyback, it means that the company plans on using some of its mounds of cash to buy its own stock back. finbold.com › guide › stock-buyback-definitionWhat is a Stock Buyback? Definition & Benefits of Share ... Jan 12, 2022 · A stock buyback will often follow a successful period, meaning the company will have to buy its own stock at a higher valuation. For investors though, it can be tricky to suss out whether a company’s decision to repurchase shares is a sound one or one motivated by manipulating financial metrics and therefore ultimately misleading. What Are Share Repurchases? | The Motley Fool Dividend payments are probably the most common way, but a company can also choose to engage in a share-buyback or share-repurchase program. Both terms have the same meaning: A share repurchase (or ... za.investing.com › news › ge-surges-on-plans-for-3GE Surges on Plans for $3 Billion Share Buyback - Investing ... Mar 09, 2022 · Investing.com – General Electric (NYSE: GE ) stock gained 3.1% in premarket trading Wednesday after the company said it will buy back shares for up to $3 billion. Repurchases will be made from time to time in the open market, the company said without specifying an expiration date for the exercise ...

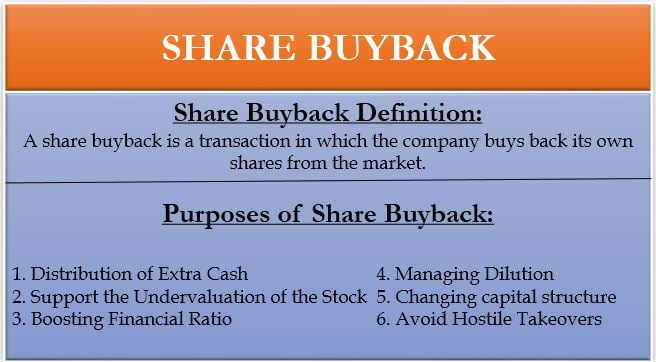

Share Buyback | Definition, Example, Methods, Purposes A share buyback is a transaction in which a company buys back its own shares from the open market. Another term for it is share repurchase. There are various methods to buyback shares. The company can buy back the shares from the market or tender offer. The shares bought back will be reclassified as treasury shares or it will be canceled ... ExxonMobil earns $23 billion in 2021, initiates $10 ... ExxonMobil earns $23 billion in 2021, initiates $10 billion share repurchase program. IRVING, Texas - February 1, 2022 - Exxon Mobil Corporation today announced fourth-quarter 2021 earnings of $8.9 billion, or $2.08 per share assuming dilution, resulting in full-year earnings of $23 billion, or $5.39 per share assuming dilution. economictimes.indiatimes.com › markets › stockstcs share price: TCS adds 2% as co fixes record date for ... Feb 14, 2022 · The buyback price is at Rs 4,500, meaning a premium of 20 per cent from current prices. TCS has fixed February 23 as the record date for buyback. The IT sector giant had announced buyback of up to 4 crore equity shares spending Rs 18,000 crore. TCS' Rs 18,000 crore buyback offer subscribed 7.5 times Mumbai: The ₹18,000-crore share buyback of India's largest software exporter Tata Consultancy Services was subscribed more than 7.5 times on Wednesday - the last day for tendering of shares. Investors offered 30.12 crore shares in the buyback process, which started on March 9, against the company's offer of four crore shares.

DGAP-Adhoc: Airbus reports share buyback transactions 23 ... The transactions are part of a share buyback programme that started on 23 February 2022 for the sole purpose of covering Airbus' long-term incentive plan in shares. The repurchased shares will be ...

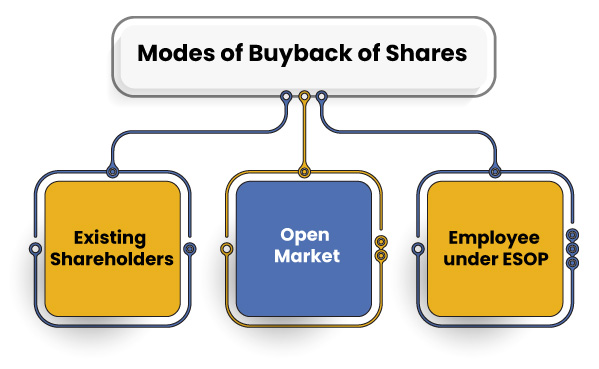

Buyback of Shares - Latest Share / Stock Repurchase in ... Buyback. Buyback of shares or stock buyback refers to the corporate action where a company repurchases its own shares from the existing shareholders. During the buyback of shares, the price of shares is usually higher than the market price. Buyback of shares can be done either through the open market or through tender offer route.

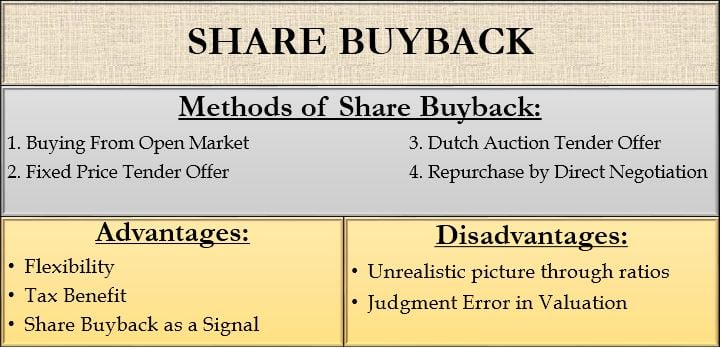

What Stock Buybacks Mean to Investors | InvestingAnswers Also called a share repurchase program, stock buybacks are a way a company returns wealth to the shareholder by purchasing outstanding shares of its own stock.A stock buyback is generally conducted in one of two ways: buying shares in the open market over time or tendering an offer to existing shareholders to buy shares at a fixed price. Most commonly the company will repurchase shares of its ...

Buyback 2022: Upcoming & Latest Share Buyback Offers with ... What is Share Buyback Meaning? Stock buyback means publicly traded companies buying back their own shares from the shareholders. Company funds their buyback with surplus cash. A buyback is also known as repurchase is purchased by the company of its outstanding shares that decreases the number of shares in the open market.

Buy-back of shares as per Companies Act, 2013 Buy Back of shares meaning: A buyback of shares is buying back of own shares by a company that was issued earlier. It is a corporate action event wherein a company makes a public announcement for the buyback offer to acquire the shares from existing shareholders within a given timeframe. The company announces an offer price for the buyback that ...

What Is Buyback of Shares - Meaning, Process, Reasons and ... For the longest time, the concept of share buy back remained buried under the Companies Act, 1956. It was the amendments to Sections 68, 69, and 70 of this Act that redefined and systematically put out the share buyback meaning and process.

› what-is-share-marketWhat is Share Market - Meaning & Definition of Share Market ... Nov 09, 2017 · What is Share Market? The process where shares of a company are bought & sold in an exchange. Get to learn Share Market Meaning, different types of Share Market like Primary & Secondary Share Market & much more to get you ready for the share market.

What does TCS' buyback mean for its stock It has announced a buyback of up to 4 crore shares with the IT company buying shares at ₹ 4,500 per share. This is nearly 17%, premium compared to its last traded price of the stock on the NSE ...

Bank share buybacks: What they mean for you The buyback price will comprise two components - a capital component of $21.66 and a fully franked dividend, which will be the difference between $21.66 and the final sale price, minus the ...

› share-buybacksShare Buybacks - The Motley Fool UK As investing jargon goes a share buyback is one of the simplest terms. It’s simply a company buying back its own shares. It can do this in one of two ways. The first, and by far the most common ...

What does BP share buyback mean? - Greedhead.net Share buybacks refers to purchases made by the company of bp ordinary shares, for Treasury shares or subsequent cancellation. Cash can be returned to shareholders both through the dividend (paid quarterly) and by means of the buyback programme.

WisdomTree U.S. Value Fund: High Value Buybacks | Seeking ... Share repurchase programs are opportunistic and anti-dilutive, meaning that buybacks are done at discounted valuations and result in a significant reduction to the number of shares outstanding.

What is Buyback of Shares - Meaning, Share Buyback Price ... The buyback premium is a difference between Buyback price & share price of the company stock at the date of Buyback offer. Taking an example - If ABC Limited has offered buyback of shares @ buyback price of Rs.100 & the at the date of Buyback offer, the share price of ABC Limited is Rs.80 then the Buyback Premium is (Rs.100 - Rs.80) i.e. Rs ...

Buyback of Shares Meaning - Ways, Participation, Pros & Cons Rule 1- The way shares are bought in the demat account is the same way the buyback of the share is done through a demat account. The buyback option will flash on the screen. Rule 2- investor needs to check the offer price and also for how many days the buyback offer is valid as during this time only the company will repurchase the shares.

What Is A Stock Buyback? - Forbes Advisor The main goal of any share repurchase program is to deliver a higher share price. The board may feel that the company's shares are undervalued, making it a good time to buy them.

What Does AMD's Buyback Mean for Its Stock Investors love a bit of share buyback action, and Advanced Micro Devices (AMD) has been partaking in plenty of it recently. Last week, the chip giant disclosed it had authorized a new $8 billion ...

Buyback Definition A buyback is when a corporation purchases its own shares in the stock market. A repurchase reduces the number of shares outstanding, thereby inflating (positive) earnings per share and, often, the ...

Share Repurchase Definition - investopedia.com A share repurchase, or buyback, is a decision by a company to buy back its own shares from the marketplace. A company might buy back its shares to boost the value of the stock and to improve the ...

/Screenshot2020-04-14at11.17.32AM-6d8cfcd249bd4cfa94ba0343bc2f3426.png)

:max_bytes(150000):strip_icc()/Screenshot2020-04-14at11.17.32AM-6d8cfcd249bd4cfa94ba0343bc2f3426.png)

/why-would-company-buyback-its-own-shares_FINAL-dc32eefe564647ce9c66c345230fd0a9.png)

0 Response to "42 share buyback meaning"

Post a Comment